By David Lucas

By: Asim Mohammed

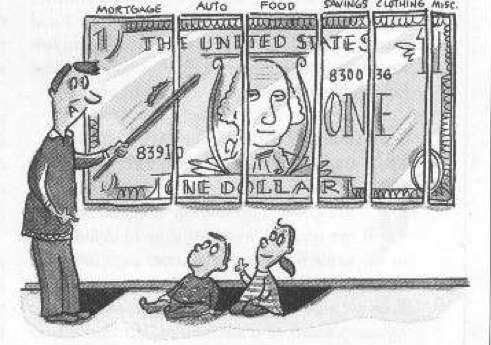

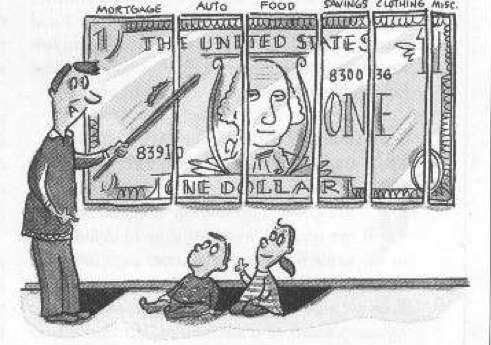

During today’s tough economic challenges many workers who are being laid off are either taking new jobs with significantly less pay or staying put at a job that they don’t find amusing or staying at a job they know wont help them achieve their career goals.

There are two different stories in each situation. Many workers who are being laid off from well paying jobs, such as six figure salary jobs are now accepting any job just to get by and support their families. For example, Shaun Chedister worked for Washington Mutual making about $125,000. After being laid off last year, Shaun spent about a year looking for a job, he finally found one with Ernest and Young as a executive administrator making a mere $66,000. Chedister and his family have had to significantly re-adjust the way they live. Their lifestyle is totally different now by looking at more affordable homes and there car being repossessed because of late payments.

The other situation is only similar in that workers have their original jobs but are afraid to move on because of the sluggish economy. Many workers are staying at their jobs even if they are unhappy. About 96% of workers said they were likely to achieve their career goals at another company. Another 46% said taking a new job in the current economic environment is risky.

Many families are feeling the crunch of a slow economy, whether it’s a family needing to adjust to a different lifestyle because of pay cuts, or a family experiencing problems at home because their spouse is unhappy with their job but they are afraid to move because of the risk of not finding another job. However there is the small niche of workers who have no fear of being laid off because of the specific companies they work at. Such companies like Southwest Airlines, FEDEX, and Aflac among others do not have a formal layout policy and many of these companies haven’t had any layoffs for lengthy periods of time, even during tough economic times. As a result these workers have nothing to fear.

http://money.cnn.com/2008/12/30/news/economy/pay_cuts/index.htm?postversion=2008123114

http://money.cnn.com/2008/12/16/news/economy/job_hopping/index.htm?postversion=2008121715

http://money.cnn.com/2008/12/09/news/economy/no_layoffs/index.htm?postversion=2008121111

By Craig Rozelle

By Craig Rozelle

Written by: Keun H. Maeng

Written by: Keun H. Maeng By Walecia Konrad

By Walecia Konrad

Posted by Brendan Boesch

Each year there are nearly 1 million divorces in the United States, or about 50% of all marriages1. The real tragedy, however, is the financial devastation that occurs to many individuals after their divorce.

Too often, a divorcing individual accepts an unfair settlement and finds that a few years later he or she is experiencing serious financial challenges. Was he or she intimidated or pressured to settle? Did the offer appear to be equitable? What ever the reason, this outcome can be significantly improved upon, if not altogether avoided, if you first understand the seven most costly financial mistakes commonly made in divorce settlements.

Following are brief summaries of these seven mistakes. Each of these areas can be quite complex, so we strongly recommend that you consult a professional prior to making a financial decision that may affect the rest of your life.

Click Here to Read More

Posted By: Brendan Boesch

There are many preparations a family must make when planning to have a child. One of the most important considerations when bringing a baby into the world is to make sure that your personal finances are in order. It is never too early to start planning for the additional costs that having a child will bring. Such costs include the prices of furniture, baby food, formula, clothing, and toys. These costs can exceed expectations, with a bottle of formula costing up to $22 a can alone. Most items will cost more than you think they will. Having a sound financial plan will ease the stress of keeping a new baby healthy.

Other important factors need to be considered during times like this. Parents need to have a good life insurance policy, so that their kids will be taken care of if something happens to them. Another consideration that is important is a will. Having a good life insurance plan and a will ensures that your child will always be protected. With all of these events many families forget to plan for their retirement during this time period, but this is a mistake that many cannot afford to make. In addition, it would be wise to start saving for your child’s college expenses when they are still a young age.

http://www.divinecaroline.com/article/22306/33079-getting-finances-ready-baby

http://masteryourcard.com/blog/2008/06/02/10-steps-to-take-before-having-a-baby/

http://www.ncnblog.com/2008/05/07/the-financial-realities-of-having-a-new-baby/

By: Asim Mohammed

Many people believe that wealthy couples spend lavishly and extravagantly on things they don’t even need. People assume that these affluent couples have nothing to worry about except to spend money and always have the finer things in life.

To the contrary, a lot of wealthy couples try and save their money instead of spending it generously. For example the Schmitt’s, sold interests in their two companies in the same week making about $10 million each. Instead of living expensive lives, the Schmitt’s drive a 2006 Honda minivan, and live in a 2000 sq. ft house. Another couple the Shifrins, an army couple who make about $133,000 each. At first they never thought about saving but since they got married they are obsessed with saving. So far they have saved $87,500 in retirement funds and invest $500 a month in mutual funds, which now total nearly $44,000. Another couple, the Wisneski’s earn $90,000 a year together. They have no debts, or loans on their heads, so one would expect them to live in an upscale area, however they live in Oneida Wis., home to the Oneida Indian Nation. They drive two cars, a 1998 Saturn and a 2005 Chrysler. They spend very little in terms of leisurely activities. They rarely travel, opting to stay home instead, and spend about $85 on entertainment, including movies, etc. So far the couple has $44,000 in retirement savings and put in $200 a month in their Roth IRA accounts.

I always thought couples or families who were financially sound would live comfortably than most people. I never thought couples, as the ones mentioned above, would ever worry about saving their money for the future.

http://millionaires.blogs.cnnmoney.cnn.com/2008/05/15/millionaires-in-the-making-the-wisneskis/

http://millionaires.blogs.cnnmoney.cnn.com/2008/05/22/millionaires-in-the-making-the-shifrins/

Planning for a baby is a very arduous and expansive task; and while there are many issues to touch on, financial planning is probably the most important. It is vital to make sure you have the funds necessary to support your child before going about having one. However in most cases, if you waited to have a baby until you could afford it, you'd never have children at all. So here are a few things to consider when thinking about financing a baby.

The U.S. Department of Agriculture estimates it costs the average middle class family $184,000 to raise a baby from birth to age 17. Firstly, during pregnancy you will want some extra money for a variety of needs. There are classes, books, medical expenses, and clothes that are all going to break your wallet before the baby is even born. The child birthing process is a large expense as well. Then there will be all the expenses regarding actually raising the child until he/she is independent. Don’t forget that women will also have to take leave from work during a portion of this time as well, so planning ahead and saving properly is tremendously important.

The first thing you need to do is to make a minimum budget; this is just to get an idea for all the expenses you will certainly incur (note that this will be much less than all the expenses you will eventually incur come the end of the cycle). Talk to friends who are parents to get a better idea about all the expenses of having kids (diapers, formula. Etc). It is a good idea to add at least 10% to your budgeted number for emergences as well. Lastly, you always want to be thinking ahead toward college for your kids, so it is probably a good idea to start putting some money aside to earn interest while your children grow.

Sources:

http://life.familyeducation.com/budget/baby/57092.html

Greetings students. Here is your recommended reading for this week in Finance 378. In addition to reading chapter 5, this should all be read by Monday, February 8, 2009:

Changing Your Credit Score - a video on the DrBoycePersonalFinance Blog.

Investing vs. Paying Credit Card Debt - also a video on the DrBoycePersonalFinance blog

"Renting vs. Buying: Which one is for you?" - DrBoyceRealEstate blog